Customs Inspection

When working with Customs Inspection, the systematic review of goods moving across a border to verify legal compliance. Also known as border check, it acts as the first line of defense against illegal trade. Customs inspection works hand‑in‑hand with Customs Clearance, the approval stage that lets goods continue their journey after meeting all requirements, Import Compliance, the set of obligations importers must follow to avoid penalties and the wider Trade Regulations, rules that govern international trade flows. Understanding how these pieces fit together helps businesses move cargo faster and stay out of trouble.

Why risk assessment matters

Every customs inspection starts with a risk assessment. Inspectors rank shipments based on factors like origin, commodity type, and known smuggling routes. This means customs inspection encompasses risk assessment, which in turn requires solid knowledge of Trade Regulations. For example, a high‑value electronics crate from a flagged country triggers a deeper look, while low‑risk agricultural products may get a quick scan. By aligning risk scores with Import Compliance checks, authorities can focus resources where they matter most, cutting wait times for compliant traders.

Once a shipment passes the risk filter, the next step is Customs Clearance. This stage confirms that all duties, taxes, and paperwork are in order. A smooth clearance process depends on accurate documentation, correct tariff classification, and timely payment of fees. When customs clearance goes off without a hitch, it signals that the prior inspection and compliance steps were effective. In practice, businesses that invest in pre‑clearance audits see faster release times and fewer hold‑ups at the dock.

Import Compliance, the discipline of ensuring every import meets legal standards is not just a checkbox; it’s a proactive strategy. Companies that embed compliance into their supply chain can anticipate changes in tariff rates, anti‑dumping duties, and safety standards. This foresight reduces the chance of a failed inspection, which can lead to fines or cargo seizures. Moreover, compliance programs often include training for staff, automated document checks, and regular audits—tools that align directly with the goals of customs inspection.

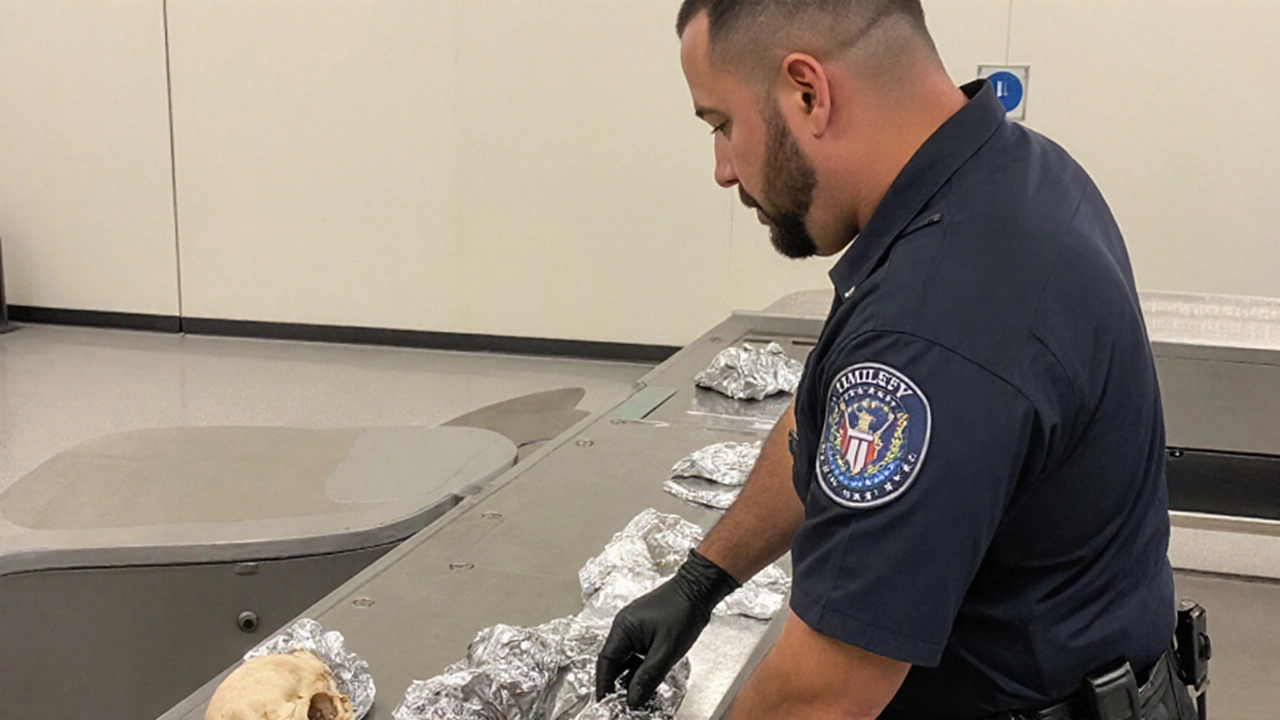

Beyond paperwork, Border Security plays a crucial role. Modern border agencies use non‑intrusive inspection technologies like X‑ray scanners, sniffing dogs, and AI‑driven image analysis to spot contraband without opening containers. These tools boost the effectiveness of customs inspection by catching hidden risks early. When combined with a strong import compliance framework, technology helps keep legitimate trade flowing while deterring illegal activities.

Looking ahead, the future of customs inspection is tied to digital transformation. Blockchain for trade documents, electronic single windows for filing, and real‑time data sharing between customs and traders are reshaping how inspections are conducted. These innovations promise faster clearance, greater transparency, and lower costs. However, they also demand that businesses stay current with evolving trade regulations and maintain rigorous compliance standards to reap the benefits.

Below you’ll find a curated set of articles that dig deeper into each of these areas—risk assessment, clearance procedures, compliance tactics, security tech, and upcoming trends. Whether you’re new to import logistics or looking to fine‑tune an existing operation, the posts ahead give practical insights you can start using right away.